salt tax deduction news

Tom Suozzi D-NY pushed for the cap to be moved up to at least 75000. This means you can deduct no more than.

Icymi Gottheimer Souzzi Discuss Reinstating Salt Deduction With Usa Today U S Representative Josh Gottheimer

One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about.

. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. WASHINGTON When President Joe Biden came into office last year proposing bold spending plans lawmakers from high-income states saw a chance to erase a cap limiting.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. A Democratic proposal aims to restore the SALT deduction for taxpayers who make. The lawmakers are urging colleagues to.

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. The maximum SALT deduction is. The climate change deal brewing in congress which would fund the massive investment in clean energy.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The lawmakers have asked the. Josh Gottheimer D-NJ and Rep.

December 20 2021. The congressional debate over the cap on the state and local tax SALT deduction is creating unusual combinations of groups advocating for and against. When President Trump and Republican majorities in the Senate and the House in 2017 pushed through the 10000 cap on deduction of property taxes and income taxes.

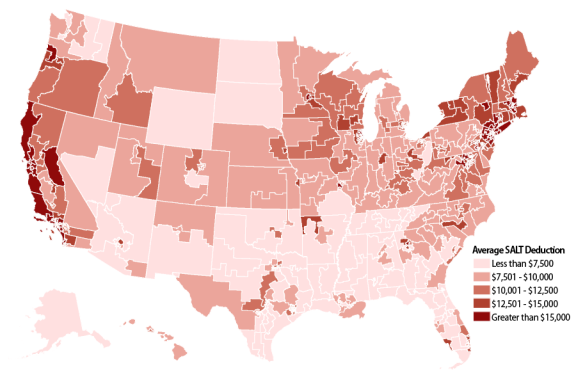

52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The SALT deduction benefits only a shrinking minority of taxpayers.

WASHINGTON Democrats are considering changing the law to let Americans deduct more state and local taxes from their federal returns as part of a major economic. Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing.

House raises salt tax deduction cap from 10k to 80k in build back. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Democrats consider SALT relief for state and local tax deductions.

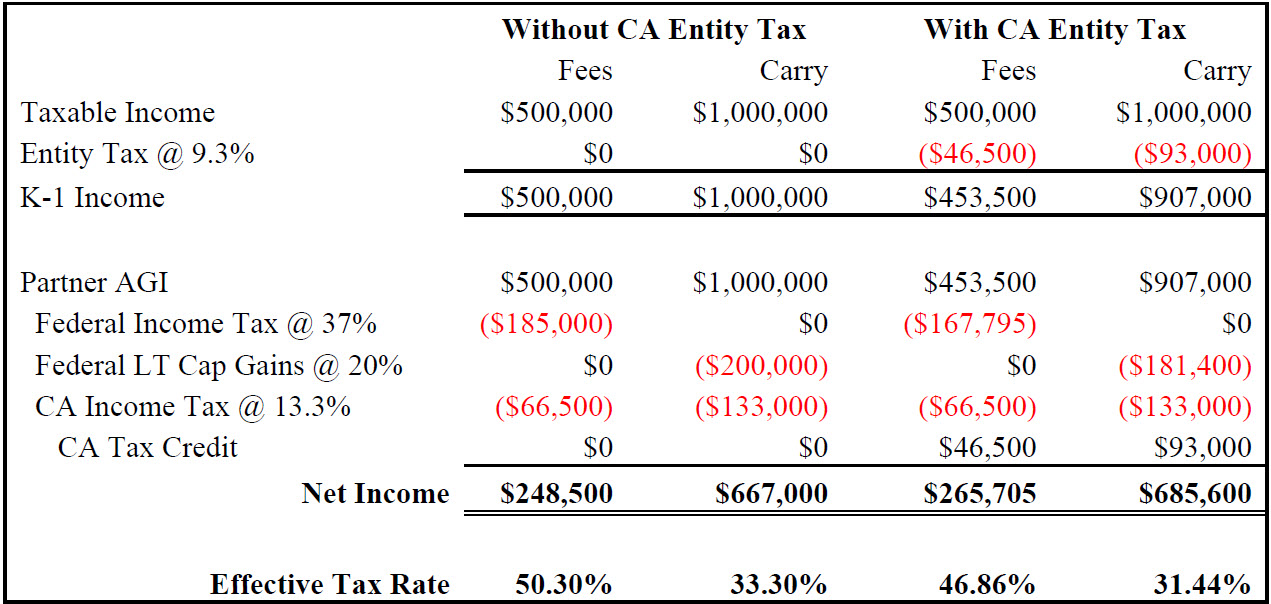

The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in. The new proposal from the Democrats raises. In the House members of the so-called SALT Caucus Rep.

Study Finds Salt Deduction Cap Graduated Income Tax Will Combine To More Than Double Tax Burden On Some Households Economic Opportunity Latest News

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

The 10 Billion Tax Cut No One S Talking About The S Corporation Association

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

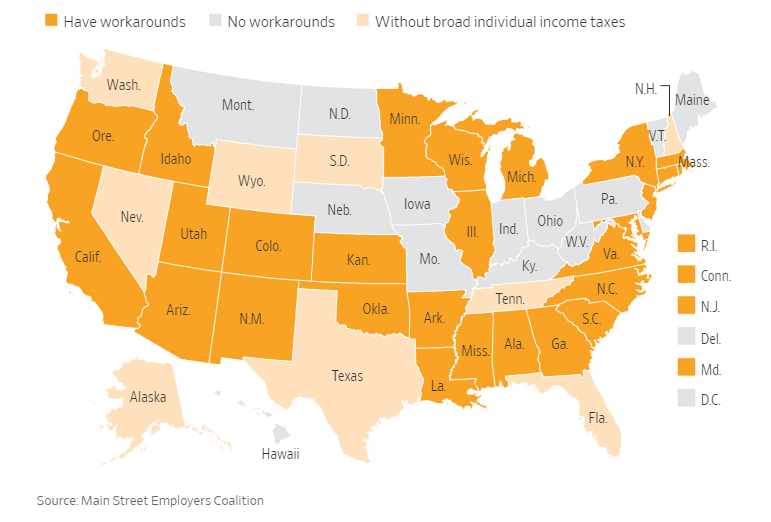

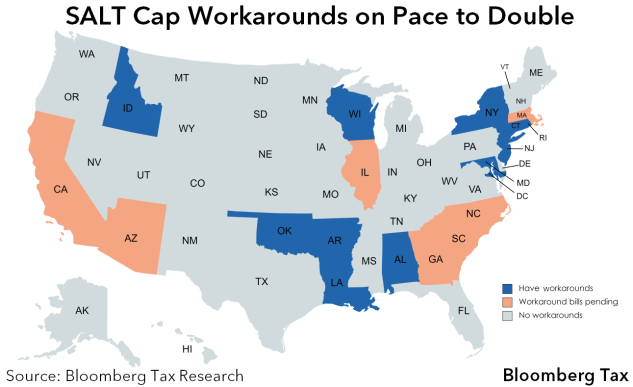

Salt Workarounds Spread To More States As Democrats Seek Repeal

Salt Parity Main Street Employers

Client Alert Gov Newsom Signs A B 150 Salt Workaround Shartsis Friese Llp

Colorado Salt Parity Act Salt Cap Deduction Denver Cpa Firm

The Salt Cap Overview And Analysis Everycrsreport Com

Why This Tax Provision Puts Democrats In A Tough Place Time

How Taxpayers Can Deal With New State Local Deduction Caps Ap News

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Cap Repeal Salt Deduction And Who Benefits From It

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

What The Property Tax Deduction Cap Could Mean For Taxes Credit Karma

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Unlock State Local Tax Deductions With A Salt Cap Workaround Green Trader Tax

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth